By Becca Gregg Sansom, Corporate Communications Specialist

January 27, 2022

Inflation is spiking at levels we haven’t seen in decades – and for some, even in our lifetime. It’s affecting our wallets at home and changing how we conduct business, as the unprecedented rise in the cost of commodities continues to have a major impact on how we work and our bottom line.

But why now? And what does it mean for the Insurance industry? Donegal’s Chief Underwriting Officer, Jeff Hay, has been keeping a close pulse on things and shares his insight in this conversation.

Why should the insurance industry be concerned

about inflation now?

“As we’ve all heard in the news recently, there has

been lots of talk around supply chain disruption

and labor shortages due to what’s being referred

to as the ‘Great Resignation.’ People are seeking

different jobs or quitting their jobs without anything

to go to, and it’s really having a dramatic impact on

the cost of goods and services in recent months,

across all industries. The insurance industry is no

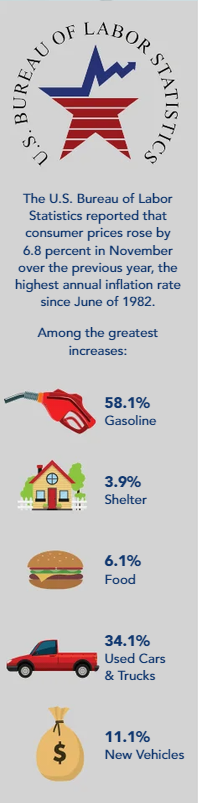

exception to that. While food costs are up 5.4%

overall, meat, fish and eggs are up 20%. Looking to

housing and construction, residential building costs

are up 15% for 2021, up over dramatic increases

in 2020. New vehicle prices are up 11% and used

vehicle prices are up 31%.”

Have we seen this type of inflation before, and what

role has Covid played?

“This is a level of inflation that the vast majority of

us working today have not seen in our careers –

and we need to understand what impact that has

to our business so that we can take the appropriate

action. I believe there are several factors really

driving this: The economy itself has seen one of

the longest running increases since 2009 and the

Great Recession. People have been doing well,

and we’ve seen generally low unemployment rates

and high investment returns. Equity markets have

done very well, and because of concerns over

Covid, money has been pumped into the economy

to keep it healthy. As a result, wealth has increased.

There are theories that because people have been working from home during the pandemic,

they’ve been contemplating their quality of life

and their investment in their careers, and with

the combination of that, there’s an inflection in

the wealth that’s been created. We have a lot of people retiring earlier than planned or quitting their jobs and pursuing different paths of passion. When supply is decreasing and demand is increasing, that’s going to cause prices to increase, which is what we’re experiencing now.”

Jeffrey T. Hay

Chief Underwriting Officer

How has the insurance industry felt the impact?

“In insurance, we are in the business of restoring lives when an accident or loss happens. The way we do that is by paying for the cost of repair or replacement, to either a business, a home or a vehicle. These costs are rising precipitately. With that, scarcity of goods are not only driving up costs of repair, but making repairs take longer, thus increasing the claims costs we pay for rental cars, Additional Living Expense for homeowners displaced from their home due to a loss and Loss of Income claims for businesses.”

How can agents position themselves to successfully navigate these times?

“My advice would be that agents focus in two areas. One, in recognition of the cost increases we are all facing, agents should be even more diligent to ensure that their customers’ coverage limits are adequate. Customers do not want to find their historical limits to be insufficient to reconstruct or replace their property in the event of a loss, leaving them to hold the bag for the excess. The second is to set the expectations for price increases with your customers, as it’s only a matter of time, depending on the carrier. Those carriers that are increasing prices now are clearly recognizing these impacts, while those that are not will likely be forced to increase prices more dramatically in the near future.”

How is Donegal pivoting to address the challenges of inflation?

“Donegal is concerned with the impact that inflation will have on our policyholders, so we are looking to ensure adequate coverage while taking early, moderate rate actions to recognize these cost increases now. We believe this will mitigate the need for more dramatic increases in the future.”

…