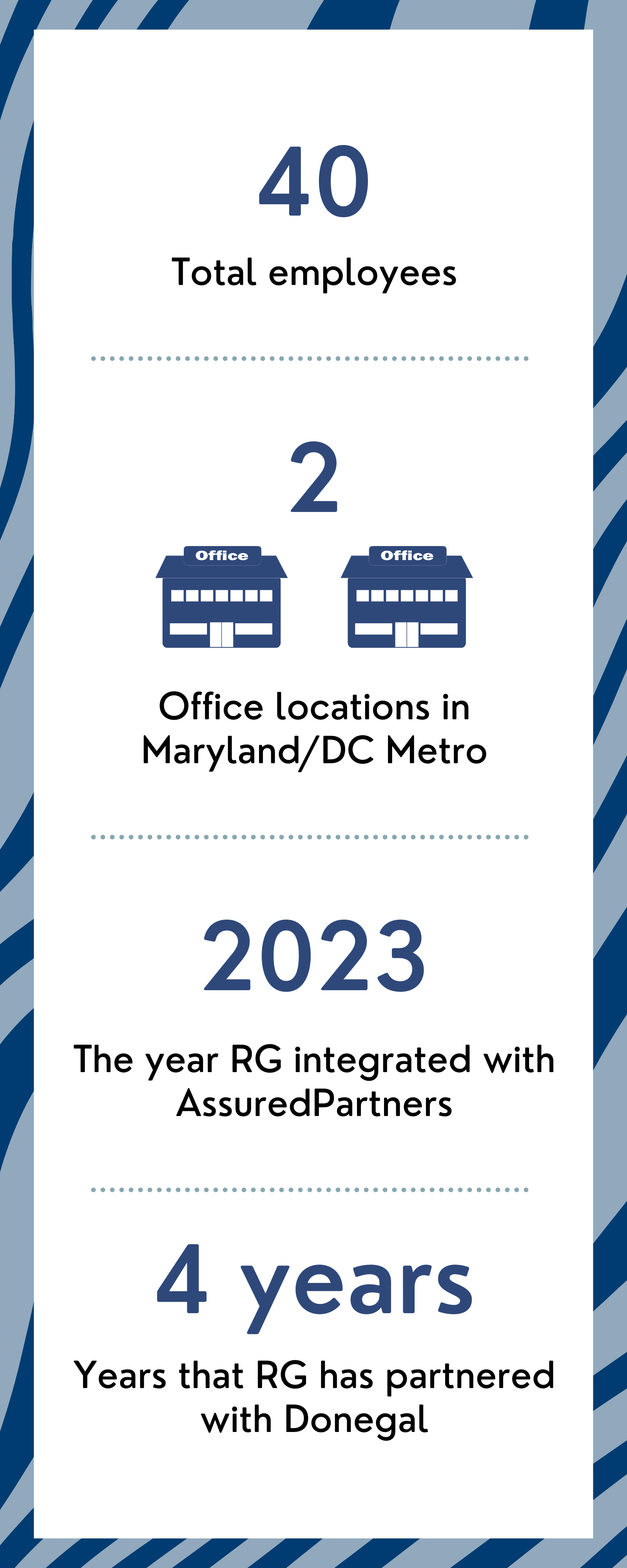

This issue, we’re putting the spotlight on Maryland-based RG Insurance, part of AssuredPartners!

Based in Rockville with a second location in Annapolis, RG was established in 2001, and today, is one of the fastest-growing agencies in the Mid-Atlantic region. With seven completed agency acquisitions to date, RG is a leader in the insurance brokerage community, offering personal and commercial insurance solutions, in addition to financial planning and employee benefits.

We caught up with Gabriel Zarate, Vice President of Business Development, to reflect on RG’s partnership with Donegal, and the small business success that we’ve found together!

Hi, Gabriel! What makes you the most proud of RG Insurance?

We are proud to be recognized as one of the top agencies in the industry, boasting multiple awards from our carrier partners. These accolades are a testament to our commitment to excellence, and the high standards we uphold in everything we do. But what truly sets us apart goes beyond just the awards. Our vibrant and inclusive culture, along with our impressive employee retention rates, speaks volumes about who we are. We believe that happy, motivated team members are the key to delivering outstanding results for our clients.

What makes RG’s employees great?

Our team members are truly exceptional for several reasons. Firstly, the way we all work with such diligence to understand our clients’ needs and apply our expertise to help manage risks effectively is absolutely commendable. Our team dedication ensures that we serve our clients, partners, and each other with pride. It’s no wonder RG is well known for our “work hard, play harder” attitude. We not only excel in our professional endeavors but also know how to have a lot of fun together!

RG and Donegal have partnered together for 4 years now! What stands out the most about your relationship with Donegal?

Becoming one of the top-producing agencies is a significant achievement. Our success in tapping into the niche for small businesses and the Hispanic market is truly commendable. These accomplishments highlight the strength of our partnership with Donegal and our shared commitment to providing valuable and cost-effective insurance solutions to our clients.

Can you share in your own words about the mutual small business success that RG and Donegal have found together?

RG Insurance has found success in the small business sector through its partnership with Donegal. This collaboration has been particularly beneficial for artisan contractors, as highlighted in the Tradesman Advantage program. Donegal has created a special insurance program tailored for artisan contractors, providing comprehensive coverage for buildings, tools, equipment, and materials. Additionally, the program offers Business Liability coverage for business-related bodily injury, property damage, personal injury, advertising injury, and fire legal liability. This partnership has allowed RG Insurance to offer valuable insurance solutions at a cost-effective rate, ensuring that small businesses receive the protection they need while maintaining financial efficiency. The mutual success stems from Donegal’s commitment to providing tailored insurance programs that meet the specific needs of small businesses, coupled with RG Insurance’s deep understanding of the local business landscape and personalized service approach.

The agency’s leadership team includes Josh Lansberg, Vice President of Business Insurance (left), and Gabriel Zarate, Vice President of Business Development (right).

Speaking of small business, what would you say is the secret to RG’s overall success in that sector?

The secret to our success in the small business realm lies in a combination of several key factors. Firstly, we have a deep understanding of the unique needs and challenges faced by small businesses. This allows us to tailor our insurance solutions to meet their specific requirements effectively. Another crucial aspect is our collaborative approach to Loss Control services. By working closely with Loss Control, we develop strategies to manage our clients’ risks effectively, helping them reduce costs and improve their bottom line. This partnership ensures that our clients receive tailored solutions. Lastly, our strategic initiatives, such as the Latino Market Initiative, have allowed us to tap into niche markets and address underutilized segments. By offering national resources and emphasizing collaboration, coaching, and the sharing of successes, we have equipped our bilingual producers with a more targeted approach to succeed in the Hispanic market.

What’s something interesting that we wouldn’t know about RG, or one of your employees?

First, I’ll share a delightful experience! Our leadership team was having lunch at a restaurant when, by pure coincidence, we met Shealin Mulcahy, Donegal’s Atlantic South Regional Vice President, who was also there having his lunch. He graciously introduced himself and then left. When we finished our meal and asked for the check, we were pleasantly surprised to find out that it had already been paid for! Shealin had treated us to our food! It was such a kind and unexpected gesture that left us all smiling.

Now, a fun fact from our team: Did you know that our very own Josh Lansberg (Vice President of Business Insurance) will wear a tux for a headshot? How dapper is that! And on a related note, some would say that my own hair is indestructible and never moves, no matter what! Quite the dynamic duo, wouldn’t you agree?

What advice would you share with your fellow insurance professionals?

Build Strong Relationships: At RG/AssuredPartners, we believe in the power of partnerships. Developing strong, lasting relationships with clients, partners, and colleagues is crucial. Trust is earned through collaboration, mutual respect, and open communication. By working together as true partners, you can achieve common goals and find innovative solutions to meet specific needs.

Embrace Innovation: Stay ahead of industry trends and continuously seek new and innovative solutions. Whether it’s through technology, new products or improved processes, innovation can help you better serve your clients and stay competitive in the market.

Maintain High Standards of Professionalism: Ensure that your team adheres to high standards of professionalism in all interactions. This includes clear communication, timely responses, and a commitment to ethical practices. Professionalism builds trust and credibility with clients and partners.